Self-Onboarding Redesign for Agents and Agencies

PROJECT SUMMARY

Objective

To redesign the self-onboarding experience for agents and agencies to reduce failed onboarding attempts and minimize customer service intervention.

Approach

Conduct interviews with in-house insurance experts to ensure compliance with state regulations and define user roles (e.g., agency owners, producers, assistants).

Develop detailed user flows to illustrate both the new account creation process and the process of joining an existing agency.

Propose improvements like adding CAPTCHA to prevent automated applications and simplifying decision points for users.

Test internally, focusing on clarity and ease of use.

DISCOVERY

Working Cross-Functionally

Working cross-functionally with insurance experts from both the Operations and Growth teams allowed us to confirm what was to be collected, who would be engaging with the experience, and what defined a successful onboarding process.

INTERVIEW QUESTIONS

When self-onboarding, what information is crucial for a successful and compliant appointment?

What are the various roles at any given insurance agency that we need to be accounting for?

Is there anything in the current experience which we are not capturing?

What aspects of the process are causing the most friction?

KEY ISSUES IDENTIFIED

Agents and agencies both require National Producer Numbers (NPN), but confusion arose due to their differences.

The existing flow did not differentiate between creating a new agency account and joining an existing one.

Manual intervention was often needed due to unclear messaging and confusing user paths, especially around validating NPNs through the NIPR API, which frequently displayed erroneous error messages.

No mechanisms were in place to prevent bots from auto-applying.

ROLES IDENTIFIED

Owner/CEO

Guides strategy, growth, and financials

Ensures compliance and builds key partnerships

Producer/Sales Agent

Sells insurance products to clients

Maintains strong client relationships

Account Manager

Handles renewals, changes, and service requests

Supports clients with claims and coverage needs

REQUIREMENTS FOR AGENCY APPOINTMENT

License number

State P&C Agency NPN

Brokerage agreement

E&O (Errors & Omissions)

Minimum limit

Documentation

FEIN (Federal Employer Identification Number)

USER FLOWS

Building Upon Existing Foundations

Understanding existing technical constraints, such as API calls and data collection, was crucial for ensuring the redesign fit within the current system. We created user flows to illustrate the current process and break it down to a step-by-step level looking for areas where design improvements could be made.

Checking Email Against Database

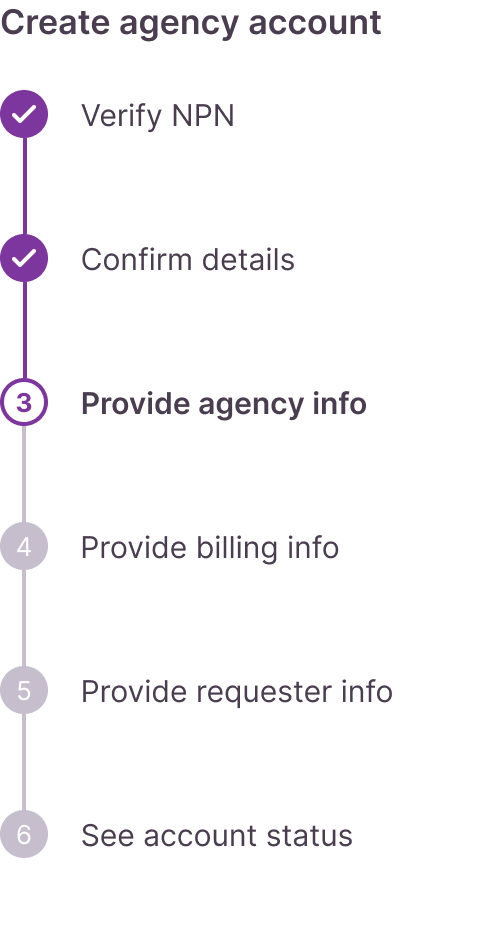

After clicking ‘Get appointed’, the user navigates to a page which asks for an ‘Agency Work Email Address’. They’d also see a stepper on the left of the screen which provides insight as to how the process will move forward.

‘START -> AGENCY INFO -> CREATE ACCOUNT -> VERIFY’

Assuming the applicant has a valid work email address (as opposed to a free email like Gmail or Yahoo), they would enter it and click ‘Continue’.

On the backend, the system would check the address against a Company table to see if an account exists.

The main purpose of the first page is to determine whether the applicant is creating a new account or signing in with an existing account. We flagged the fact that users didn’t have the ability to make this decision at the beginning of the flow as a design opportunity.

Account Exists

The next step asked if the applicant had a National Producer Number (NPN):

If "Yes," a field prompted them to enter their NPN.

If "No," they proceeded to the next screen.

Confusion arose around entering NPNs, leading to customer service calls:

An API issue caused the "Invalid NPN" error, even when valid.

Manual API resets were frequently needed, blocking users.

After confirming NPN status, users entered basic info (first name, last name, phone number, and pre-filled email).

Regardless of NPN status, users could proceed, creating extra back-end verification work:

Valid NPNs pre-filled name and email via the API, but the data wasn't always accurate.

Users without an NPN (not listed as Broker on Record) still needed access for administrative tasks.

The business priority was determining whether the user was a licensed producer, as this impacted their platform permissions. Licensed users could bind policies, while unlicensed users might still need access for billing or post-bind issues.

RECOMMENDATIONS

Remove time zone selection to reduce number of fields.

Explicitly confirm API-provided info rather than assuming users understood the source.

Provide users with ability to declare their roles in the agency.

Create New Account

Users needing to create a new account were presented with the same screen as those joining an existing account.

The system asked for the "Agency Email":

It checked the domain against the "Companies" table.

If the domain didn’t match any existing records, the system assumed a new account was being created and requested the Agency NPN.

API behavior:

If successful, the system pulled information for the next screen.

If unsuccessful, the error message inaccurately displayed "Invalid NPN," leading users to contact customer service, frustrated that their valid NPN was being rejected.

Upon successful NPN validation, users were asked a series of questions to create the Agency profile.

After completing the form, users clicked "Create Account" and were sent a verification email to create a password and start quoting and binding on the platform.

WIREFLOWS

Establishing Separate Paths

To eliminate confusion around applicants entering incorrect NPNs, we introduced separate flows for users creating a new account versus those joining an already appointed agency. This included task-specific steppers for each flow. For new account creation, we added a screen upfront that informed applicants of the required materials, giving them time to gather everything or assess their company's qualifications before proceeding.

Low-fidelity wireflow of the ‘Create New Account’ screens.

Low-fidelity wireflow of the ‘Join Existing Account’ screens.

MID-FIDELITY

Applying for an Agency Appointment

In the mid-fidelity version, we began to introduce typography along with refining the page layout. Utilizing the flow we’d established in our low-fidelity screens, the next step would be to make a clickable prototype and test internally.

Path Selection

We introduced a new concept to let users differentiate between creating a new account and joining an existing one, making each decision point more explicit in the flow.

Applicant Preparation

We added a quick screen to inform new applicants of the materials needed to complete the application, giving them a chance to gather everything before starting.

Applicant Demographics

We isolated the decision point of whether the applicant was applying for a retail or wholesale agency. Since most Cover Whale agencies are retailers, this data was crucial for the growth team to track applicant types.

Pulling information with NPN

After selecting retailer or wholesaler, the applicant was asked for their agency's NPN. This triggered an API call to NIPR, breaking the process into smaller steps to help users focus on one action or decision point at a time.

Explicit Confirmation/Expanding Company Profile

After successfully entering the agency's NPN, the next step was to display information from the API call (owner name, company name, FEIN, license number, state ID, and domicile state). For Cover Whale, confirming this data was essential for ensuring state compliance when the agency starts selling policies.

In addition to legal and compliance details, Cover Whale needed to capture billing and contact information and assess if the agency aligned with their business appetite.

Final Step

Upon successful completion and alignment with Cover Whale’s standards, the final screen instructed the applicant to check their inbox for an email with a link to create a password. They could then log in using their work email and new password.

MID-FIDELITY

Joining an Existing Account

Matching user to Agency Account

After selecting "Join Existing Account," users were asked for their "Primary Work Email" to confirm their agency and ensure account verification through their main inbox. For agencies predating the business domain rule, users were directed to customer support, triggering a Hubspot ticket.

Confirming the Match

If the email matched an existing account, users could proceed and view key agency details like Company NPN, Legal Name, DBA, and primary licensed state to confirm the correct account. Testing revealed the need for a way to confirm or backtrack if incorrect information appeared, while keeping the data read-only for adjustments.

Defining the Role

Once matched to an agency, the system checks if the user is a licensed producer to assign relevant permissions, like quoting and binding policies. Non-producers, such as accounting managers, can still access the platform for tasks like billing.

Licensed Producers

If the user is a licensed producer, they’re prompted to enter their personal NPN, clearly separated from the company NPN to prevent confusion.

Simple Profile Creation

The screen could be reached two ways: either the user answers “No” and fills out the fields manually, or answers “Yes” and the system auto-fills their name and date of birth via an API call. Testing revealed concerns about correcting inaccurate API data, prompting us to make all fields editable, regardless of how the information was entered.

Final Step

After clicking ‘Continue’, the user would be prompted to check their inbox. This both allowed the system to verify the user’s email address, s well as create a password. A resend link was provided, as well as easy access to customer service for any other issues.

FINAL DESIGN HIGHLIGHTS

Post-Testing Adjustments

In the ‘Create New Account’ screens, we originally had all the company details being collected within a single page. When we discovered that additional requirements were needed to complete onboarding successfully, we found it necessary to break the page out into multiples.

While this meant adding additional steps, it also meant that the business would be more likely to obtain the information they required and the user was more likely to complete the task all in one go. Whenever possible we used dropdown menus to reduce keystrokes.

We shifted the single stepper label from ‘Add Company Details’ to capture each block of information on it’s own page:

Agency info

Billing info

Requester info

Agency Info

This page aimed to gauge the agency's business scale, including agent count, trucking book value, small fleet percentage, and E&O limits, to assess alignment with Cover Whale's business appetite.

Billing Info

To improve tracking and resolving billing issues, we identified the need to capture specific billing contacts. This helped customer service address outstanding payments efficiently and ensured that collected information was organized and accessible on the backend.

Requester Info

With a clear portrait of the agency’s scale, book, and payment methods, the final step was to capture information on the user completing onboarding. Based on initial insights, we defined roles, allowing 'Producers/Agents' to enter their personal NPN, and used the term 'Requester' to cover all scenarios. Completing the form didn’t guarantee agency approval, but it provided Cover Whale with a fuller picture while setting realistic expectations for the user.

OUTCOME

New Foundation

The project aimed to streamline the onboarding process, automate data verification, and reduce customer service calls. Although the designs did not progress beyond the front-end phase, they provided a foundation for capturing essential user information in a clear, compliant, and efficient manner.